Crafting Financial Journeys

Jupiter • 2023-24 • App Redesign

Background

Jupiter is a digital banking app that helps users manage their finances.

It offers savings accounts, UPI payments, loans, credit cards, a spends

tracker, and various investment products - all in one place.

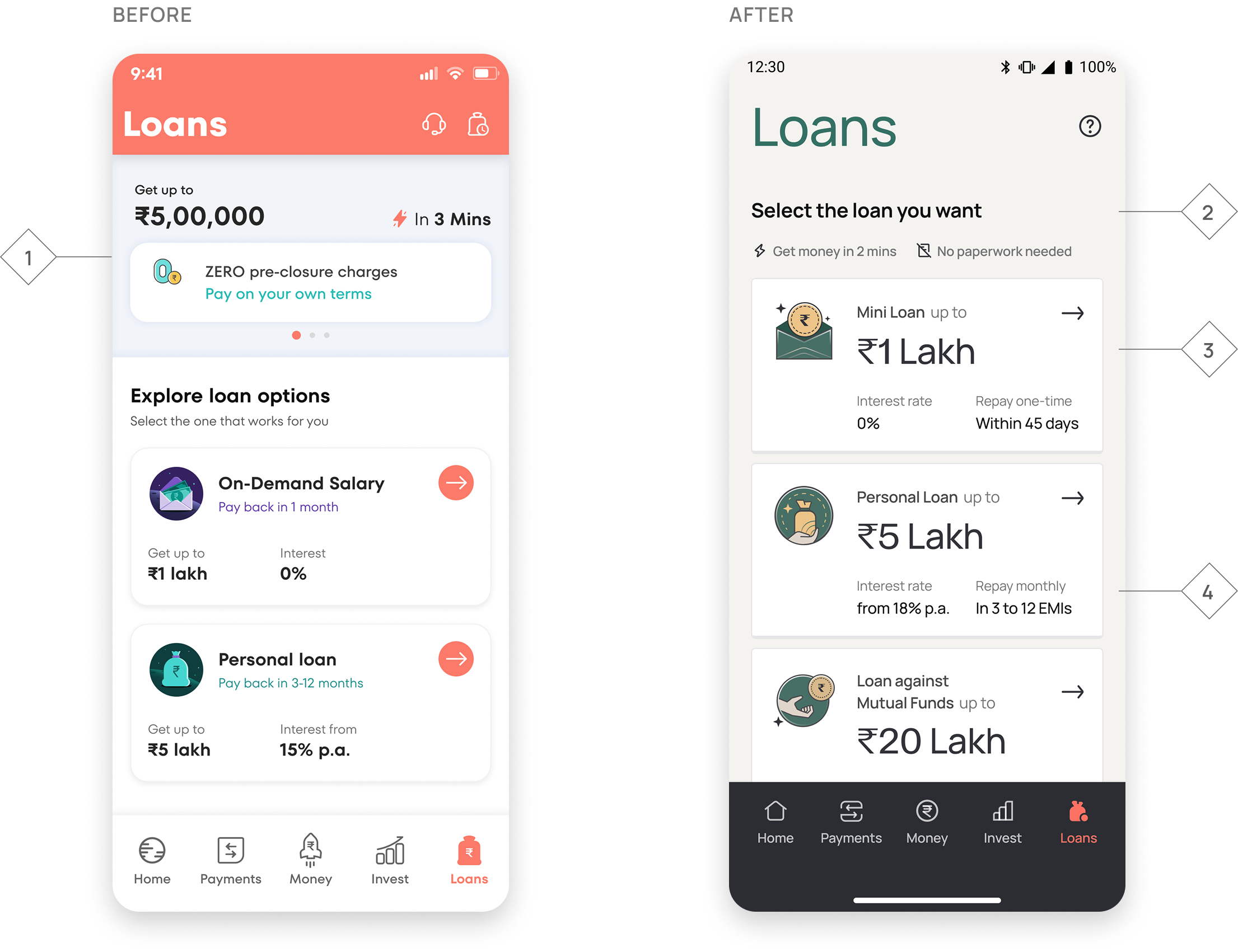

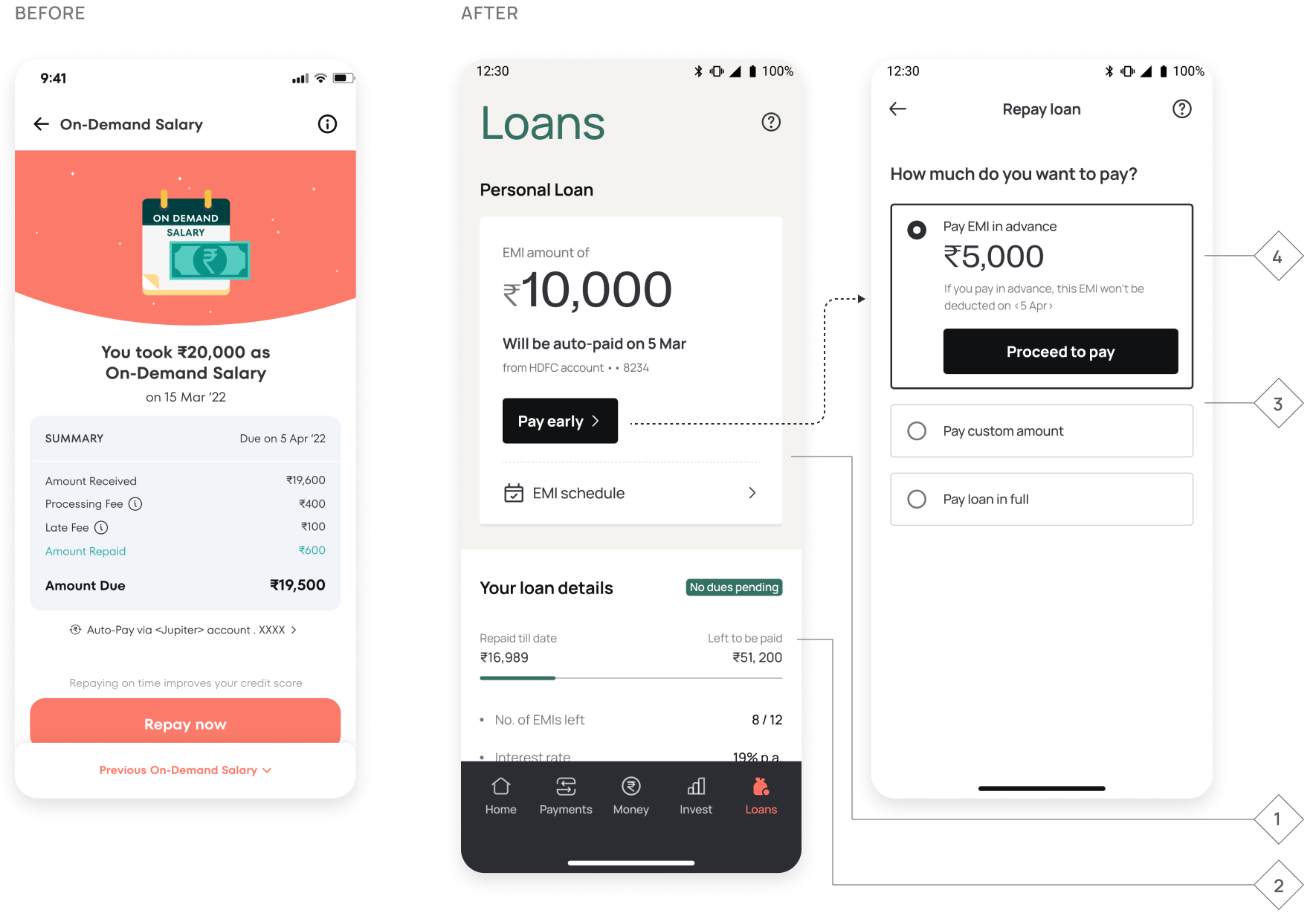

As we introduced more products and features, the UI started to feel cluttered,

leading to inconsistencies across the app. The experience became confusing,

information wasn’t structured clearly, and we struggled to build the trust

we wanted with our users. It became evident that a redesign was necessary.

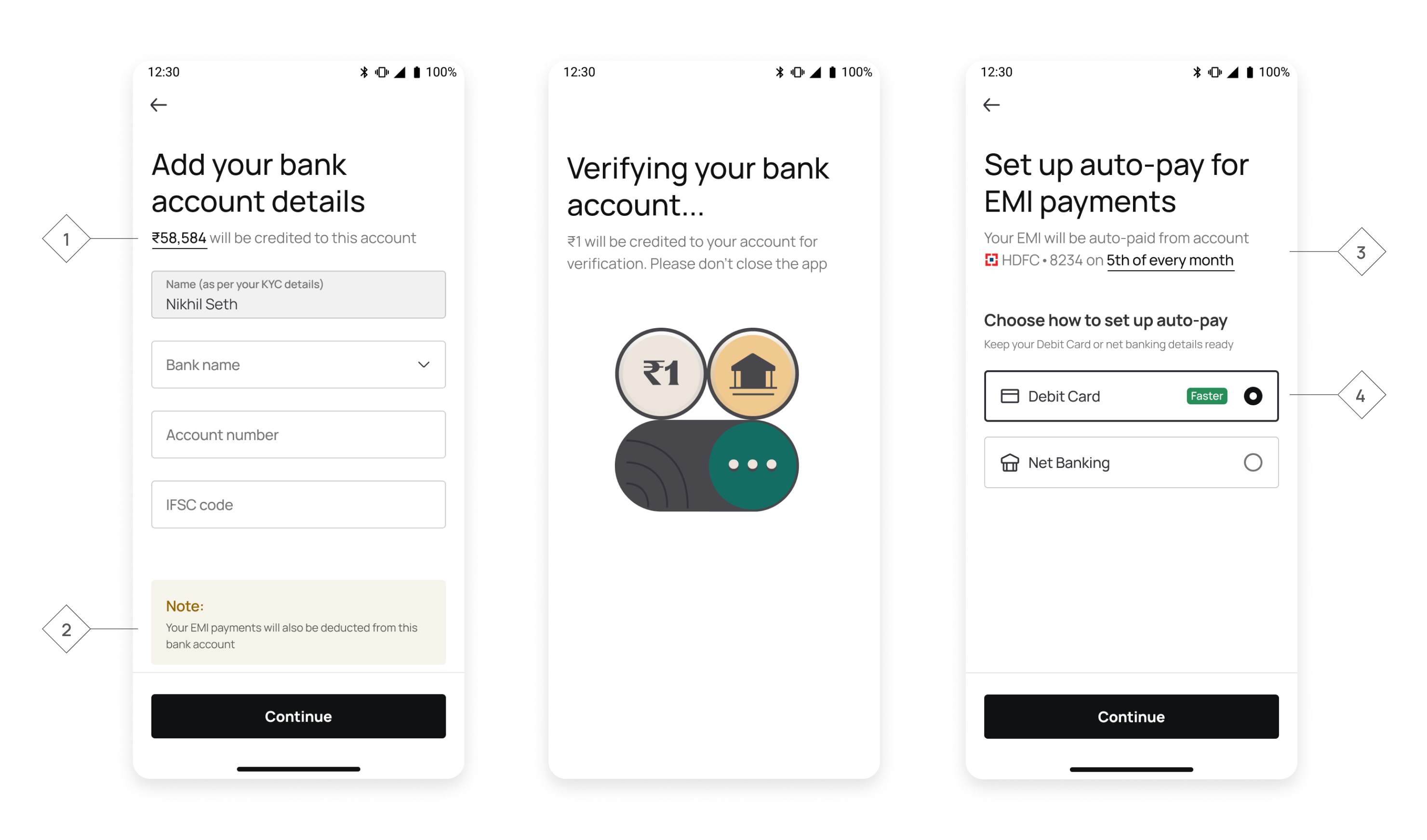

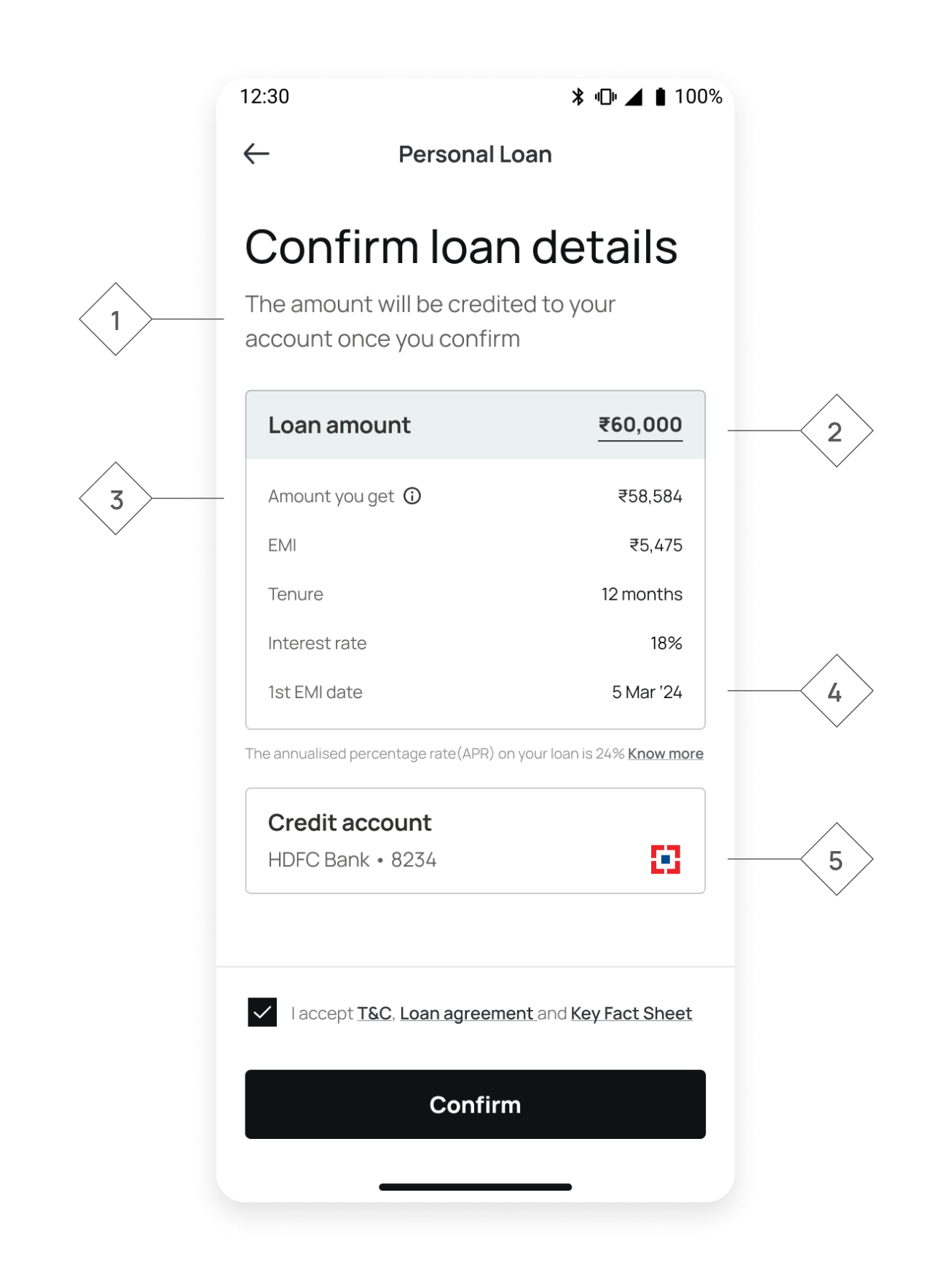

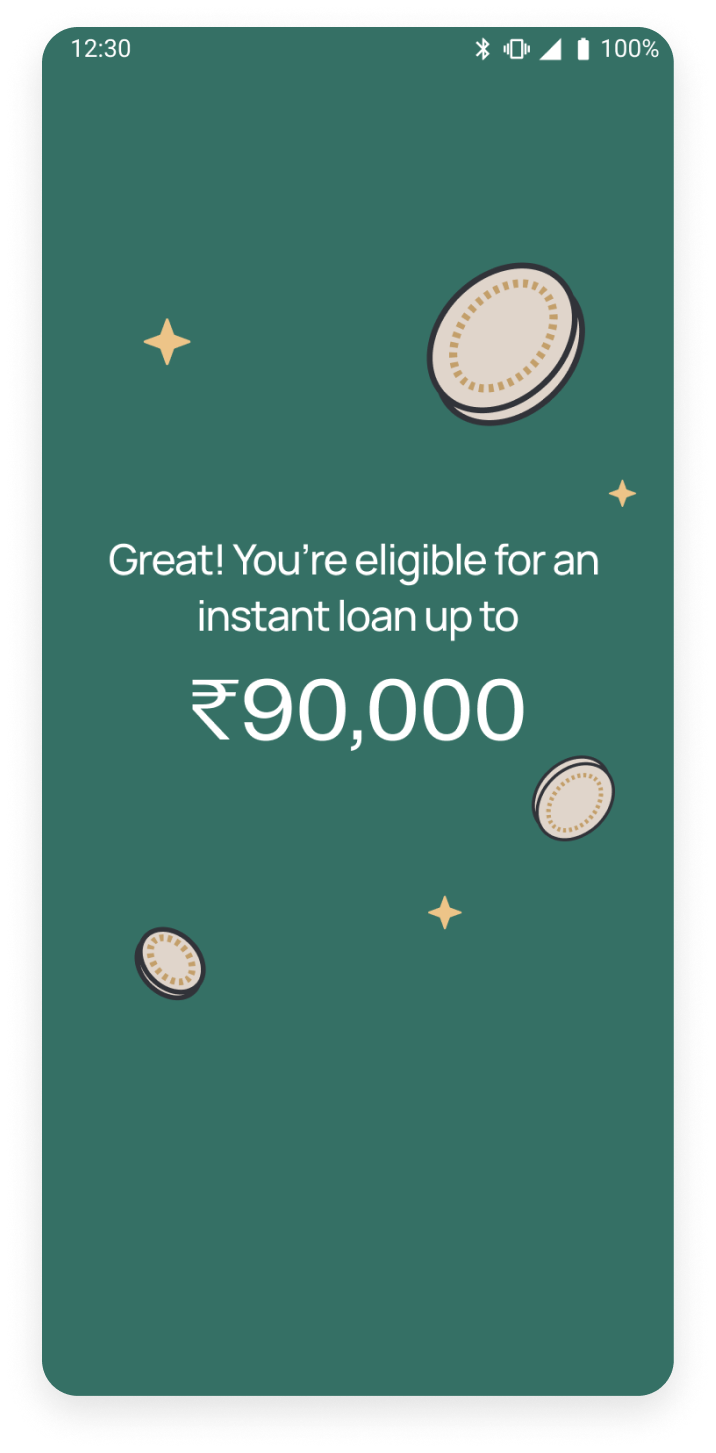

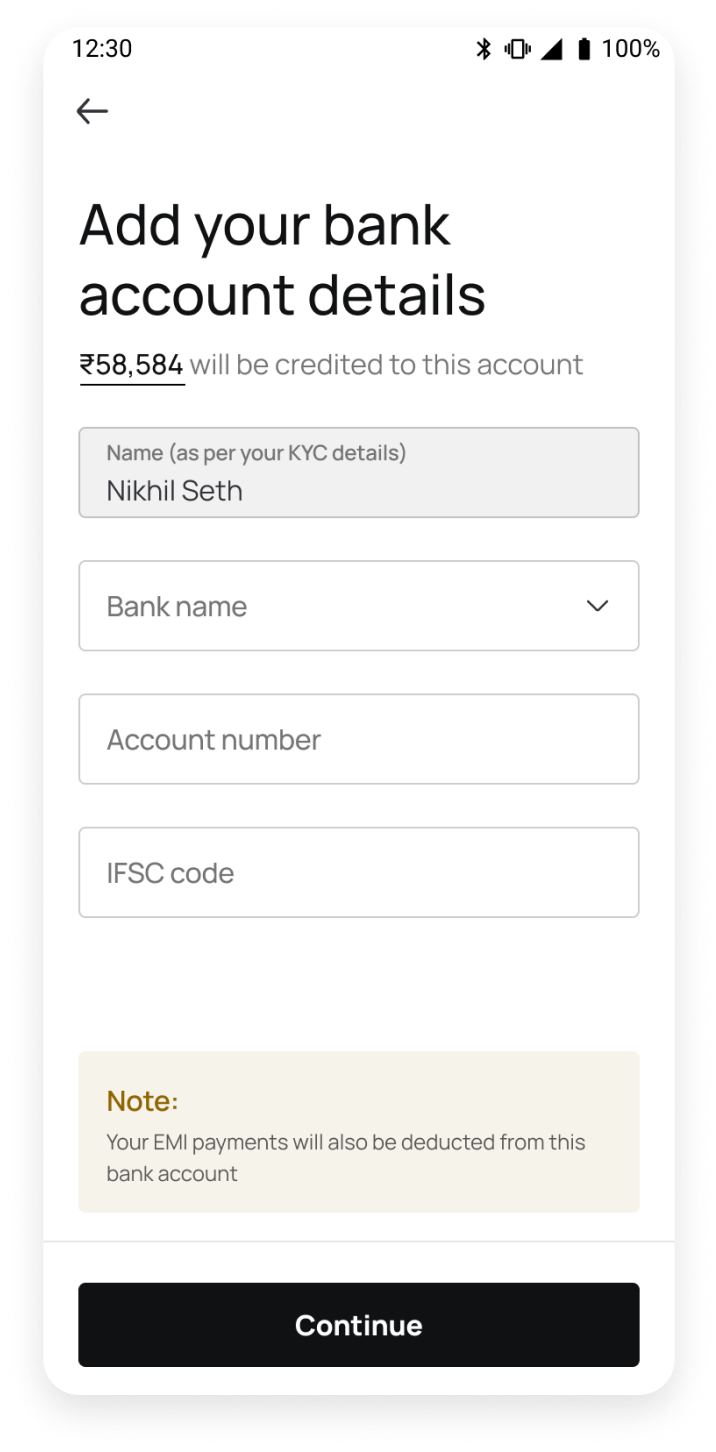

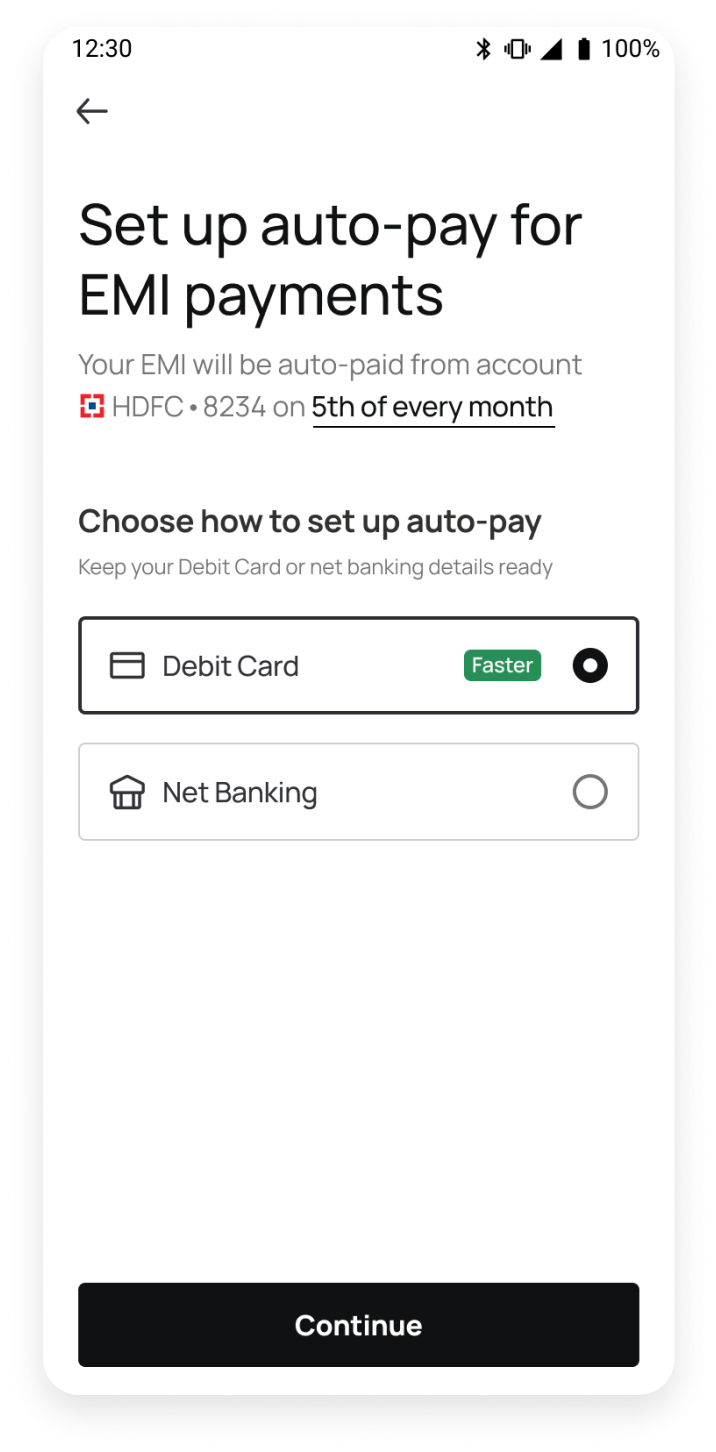

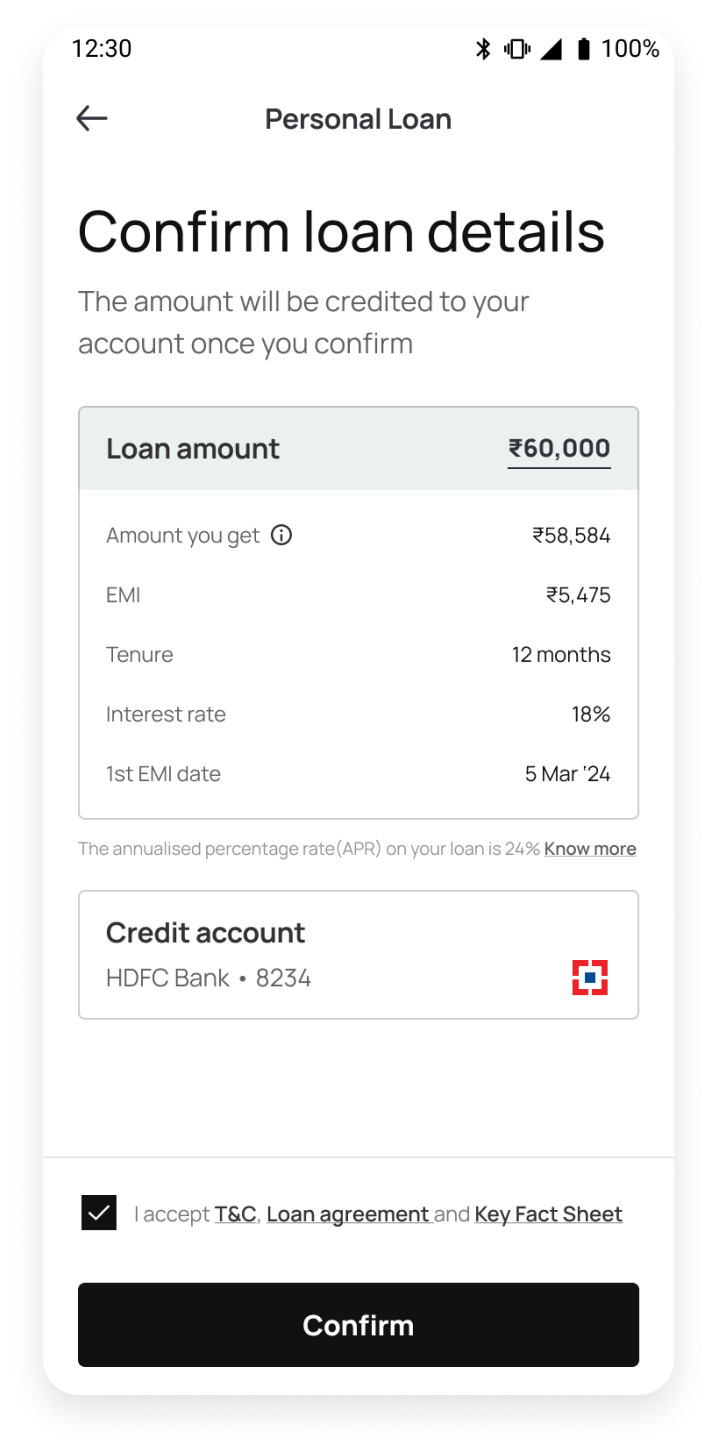

For users to trust us with their money, every screen had to feel personal

and intuitive. We needed to remove the anxiety and fear that came with taking

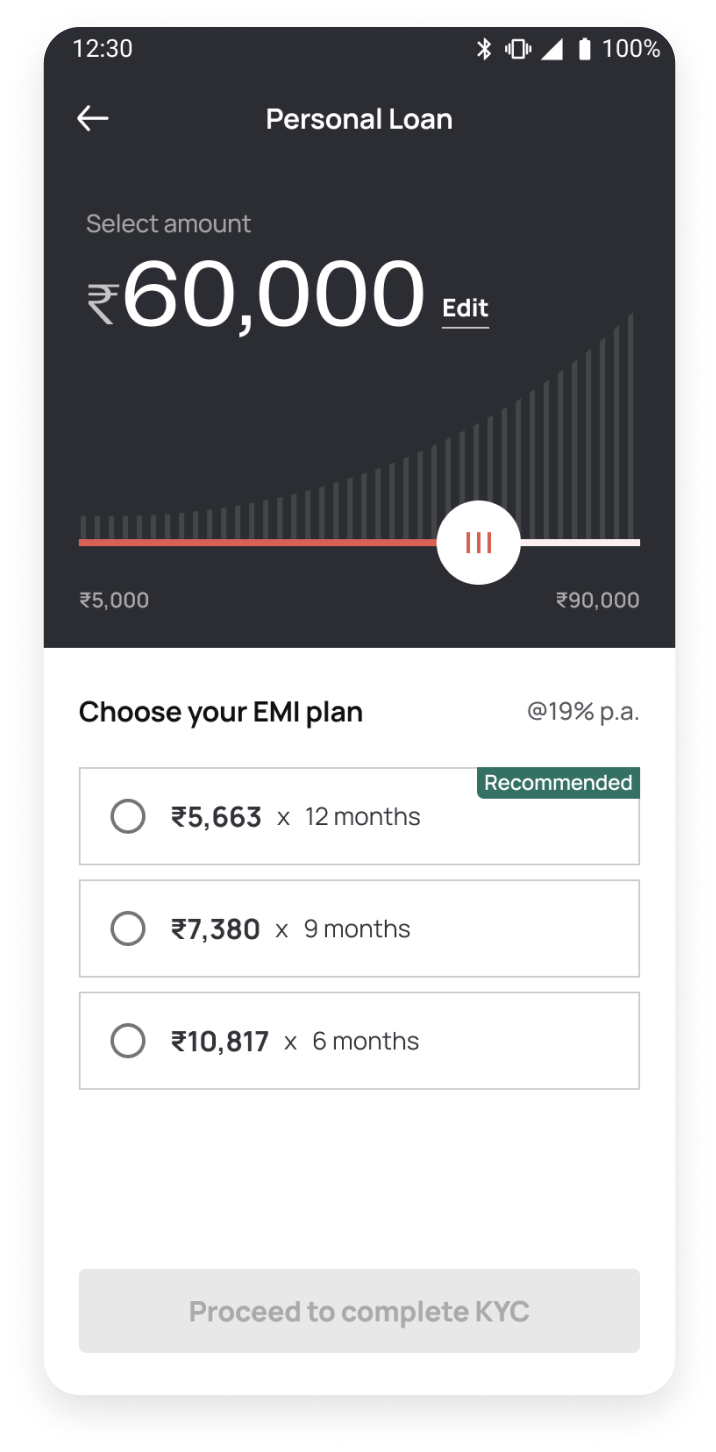

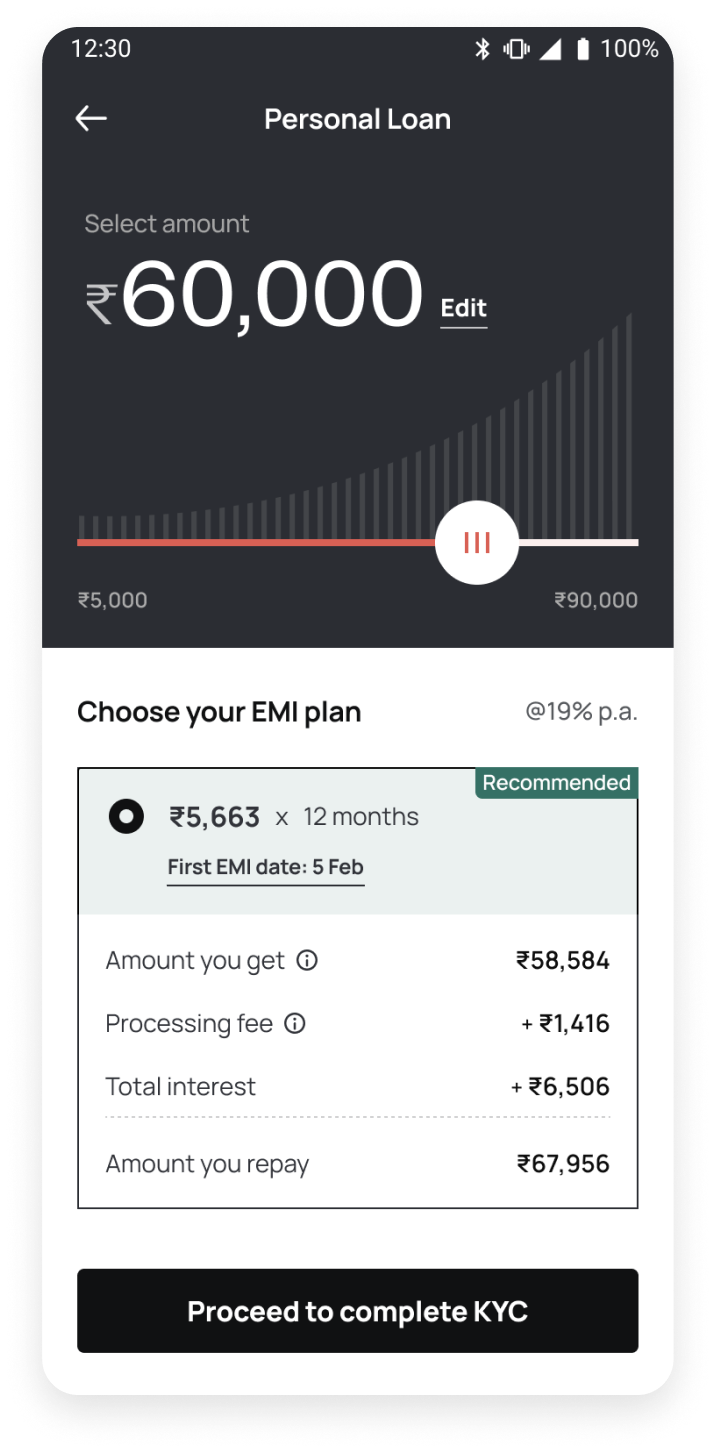

the next step, especially in journeys like taking a loan. We created new

design principles to craft screens, numbers, and interactions in a way that

will make users feel confident in their decisions.

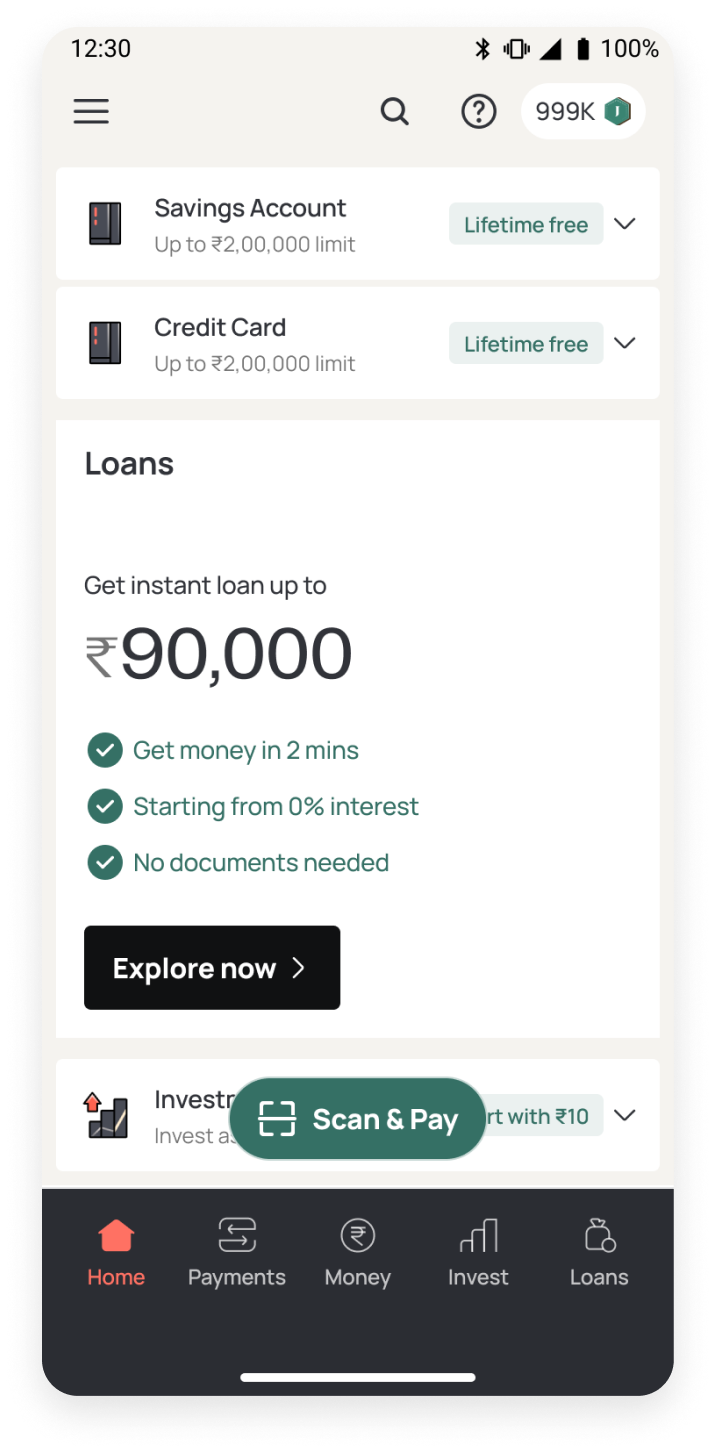

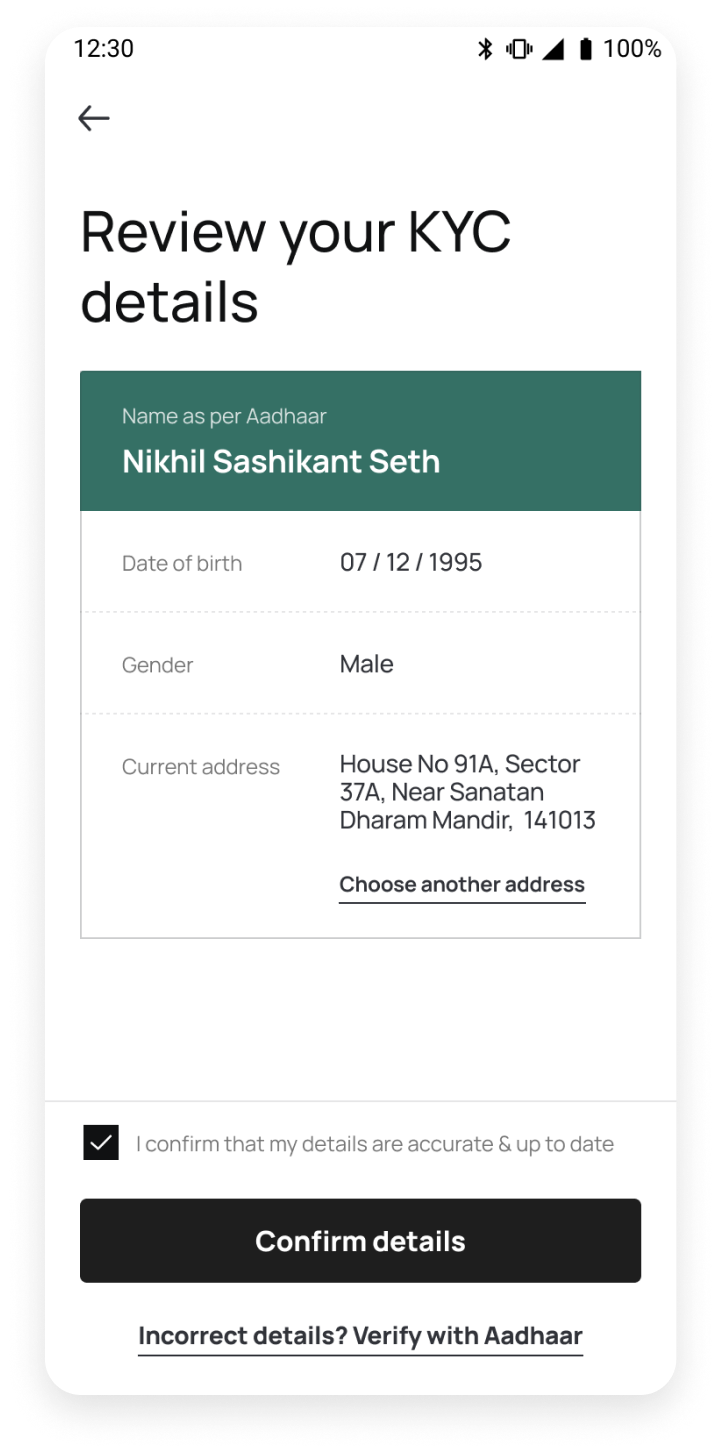

I worked with product, business, data and risk teams to truly understand

loans users - their age, income groups, credit profiles, loan purposes, when

they typically used the app, and their aspirations as well as discomforts.

These insights into users' minds helped me design journeys that genuinely

supported them at every step of taking a loan.

My Role

I led the complete redesign of loans experience, covering both pre & post-disbursement journeys. I worked with product leadership to shape journeys focused on clarity, transparency, and building trust.

The redesign covered:

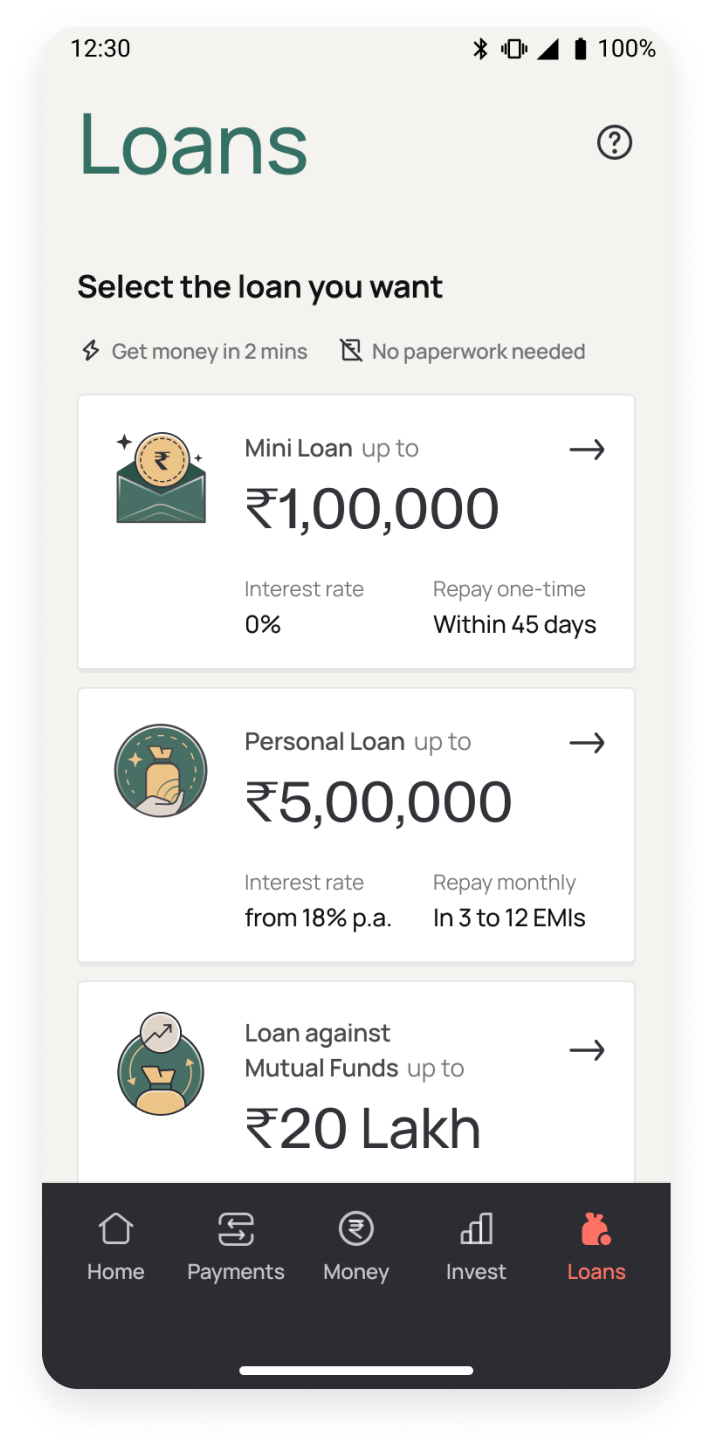

- Onboarding & Discovery - Discovery on app home, loans tab redesign, loans identities

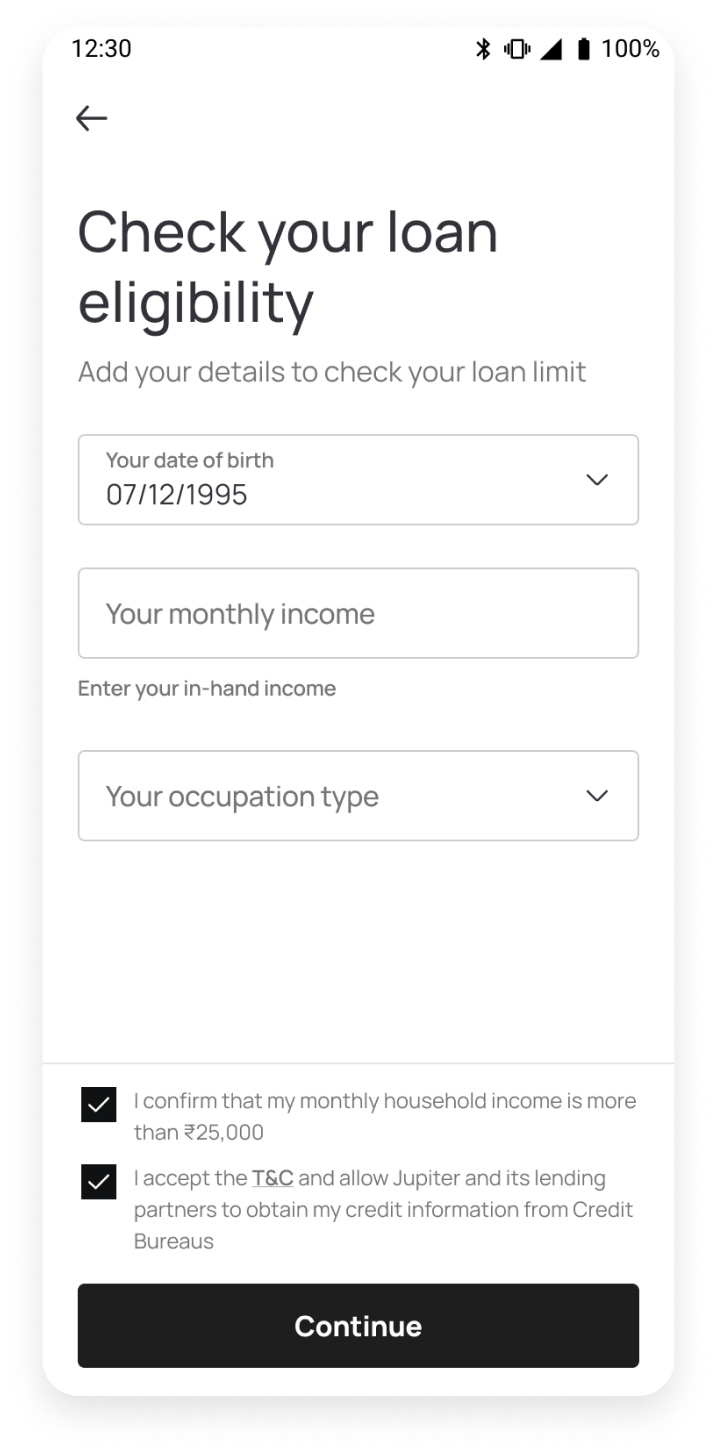

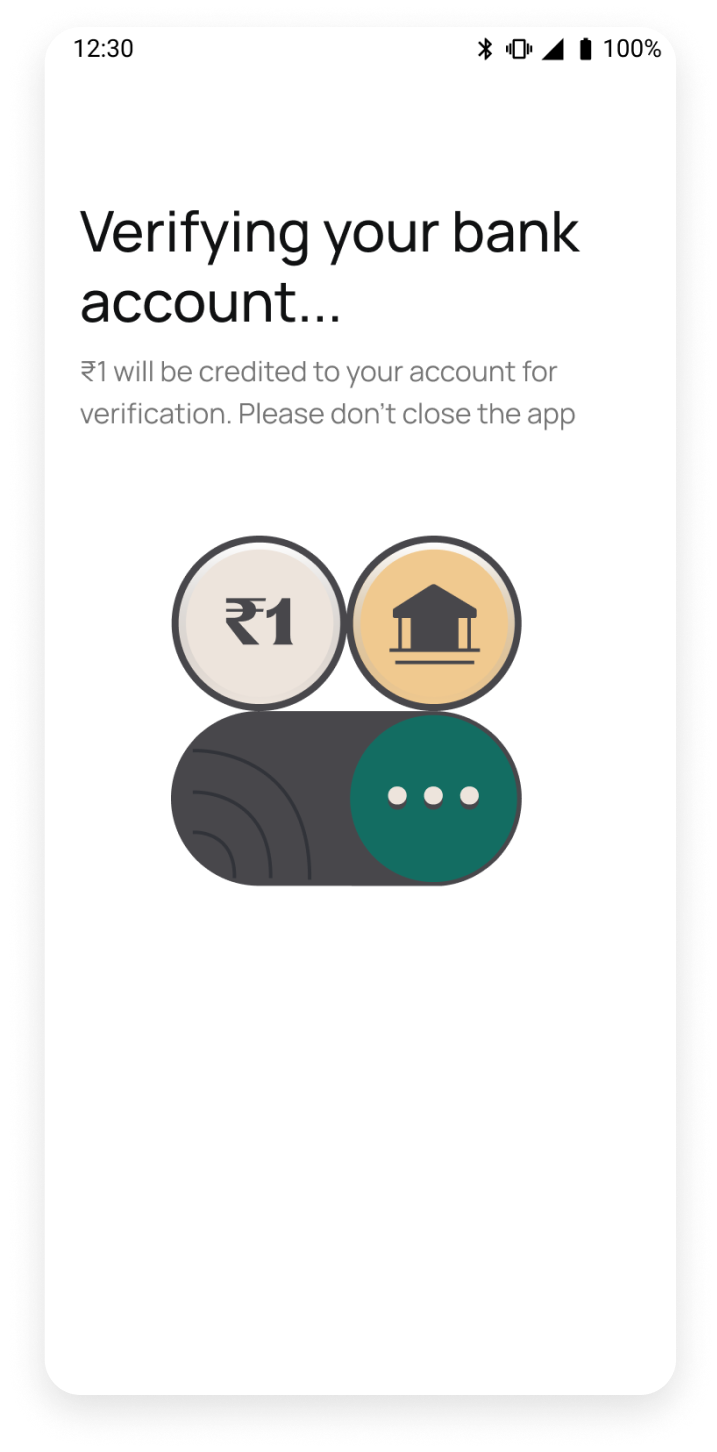

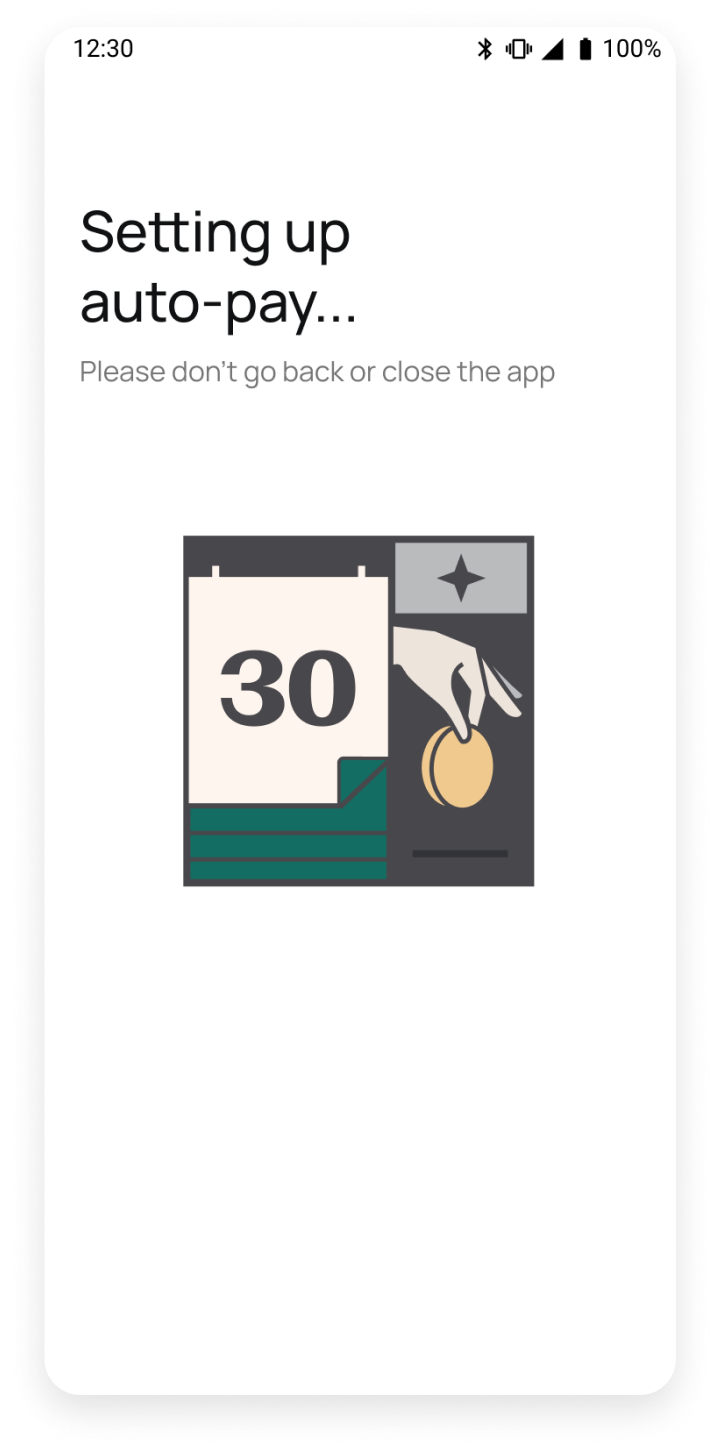

- Loan application - Eligibility check, amount and tenure selection, video-KYC verification, bank account and auto-pay setup, journeys for dropped-off & repeat users

- Checkout - Final review and disbursement

- Post-disbursal Experience - Active loan management, repayment flows

- Enhancements & features - Account aggregation, loan limit upgrades, offers on interest rates and processing fees, EMI insurance

Impact

We achieved a 24.8% increase in conversions for new users and a 27% boost for repeat users