Loans Research

Jupiter • 2024 • Qualitative Research

Background & Objective

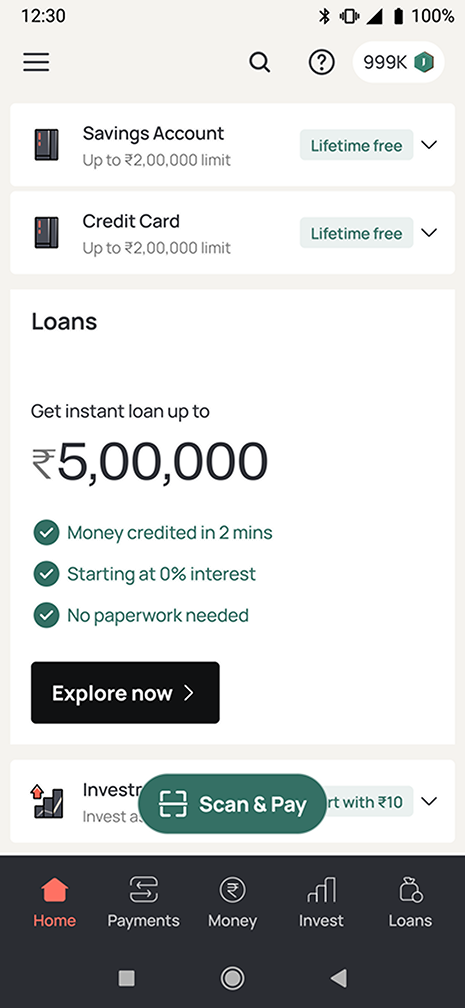

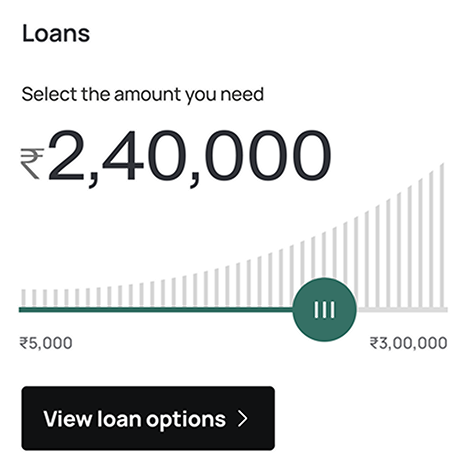

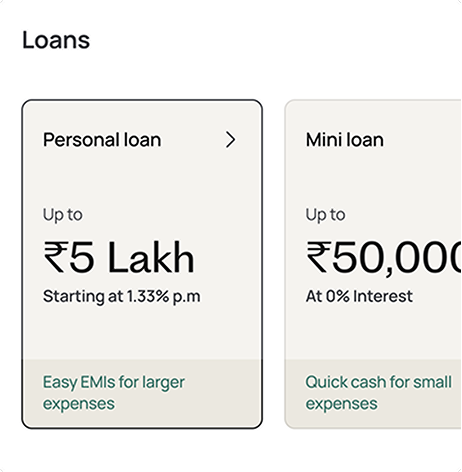

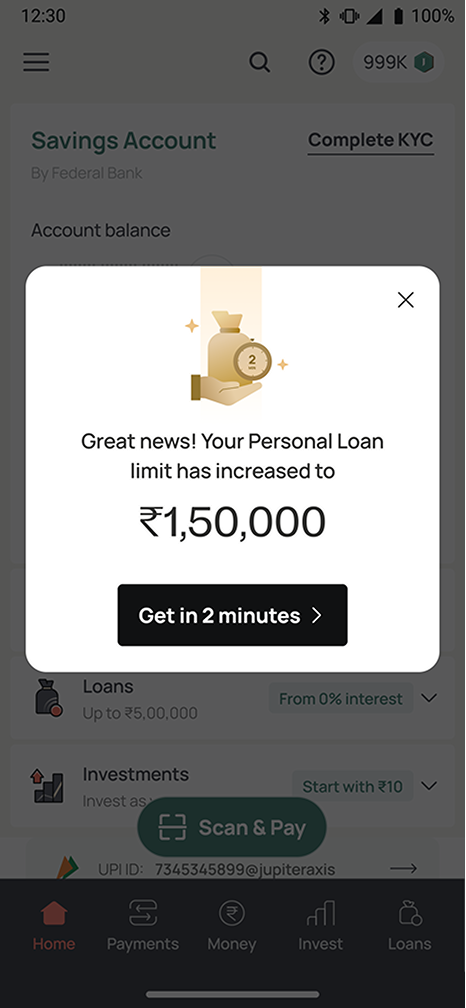

Since loans is an intent-based product , any funnel improvements often result in only incremental changes. We aimed to understand what influences our users’ decisions when considering loan options, assess their awareness of Jupiter’s loan offerings, and ensure that when they need a loan, Jupiter is top of mind.

Methodology

We conducted 30-minute in-depth interviews with 19 users across 4 selected groups, focusing on their experience with loan products.

User groups

- Band 1, 2, 3 users - have taken either a mini loan or personal loan within the last 12 months

- Band 4, 5 users - have taken either a mini loan or personal loan within the last 6 months

- Band 1, 2, 3 users - entered the funnel within last 3 months but did not take a loan

- Band 4, 5 users - entered the funnel within last 3 months but did not take a loan